401k paycheck impact calculator

For 2020 we take your gross pay minus 4300 per. State Date State California.

Do You Know What S Being Deducted From Your Paycheck Gobankingrates

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

. Second many employers provide matching contributions to your account which can range from 0 to 100 of your contributions. You only pay taxes on contributions and earnings when the money is withdrawn. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. See how increasing your contributions to a 401k can affect your paycheck and retirement savings. Salary Your annual gross salary.

This calculator has been updated to. Use this calculator to see how increasing your contributions. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

How frequently you are paid by your employer. Using the calculator In the following boxes youll need to enter. Many employers provide matching contributions to your.

The output and other information you will see here about the. Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings. Subtract 12900 for Married otherwise.

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. State and local taxes This is the percentage that will be deducted for state and local taxes. All contributions and earnings are tax-deferred.

Select your state from the list below to see its 401k calculator. Paycheck Calculator Every dollar counts A small change to your paycheck can mean a big impact to your retirement savings. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local.

Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo. Gross Pay Calculator Plug in the amount of money youd like to take home. This calculator is provided only.

The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and. Elective deferrals into both 401k and 403b plans during the calendar year are subject to. 100 Employer match 1000.

Your expected annual pay increases if any. The maximum elective deferral amount is 20500 in 2022 for 401k 403b and 457 plans. Change state Check Date General.

The information presented above is hypothetical and is not intended to serve as a projection or prediction of the investment results of any specific investment. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. When you make a pre-tax contribution to your.

While your plan may not have a deferral percentage limit this calculator limits deferrals to 80 to account for FICA Social. Find a Dedicated Financial Advisor Now. This calculator allows from 0 to 99 allowances.

For some investors this could prove to be a better option than the Traditional 401 k contributions where deposits are made on a pre-tax basis but are subject to taxes when the. Do Your Investments Align with Your Goals. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings.

The impact on your paycheck might be less than you think. 2022 Federal income tax withholding calculation.

Gross Pay And Net Pay What S The Difference Paycheckcity

401k Calculator

401 K Calculator Paycheck Tools National Payroll Week

Pennsylvania Paycheck Calculator Smartasset

Solved W2 Box 1 Not Calculating Correctly

Microsoft Apps

401k Contribution Impact On Take Home Pay Tpc 401 K

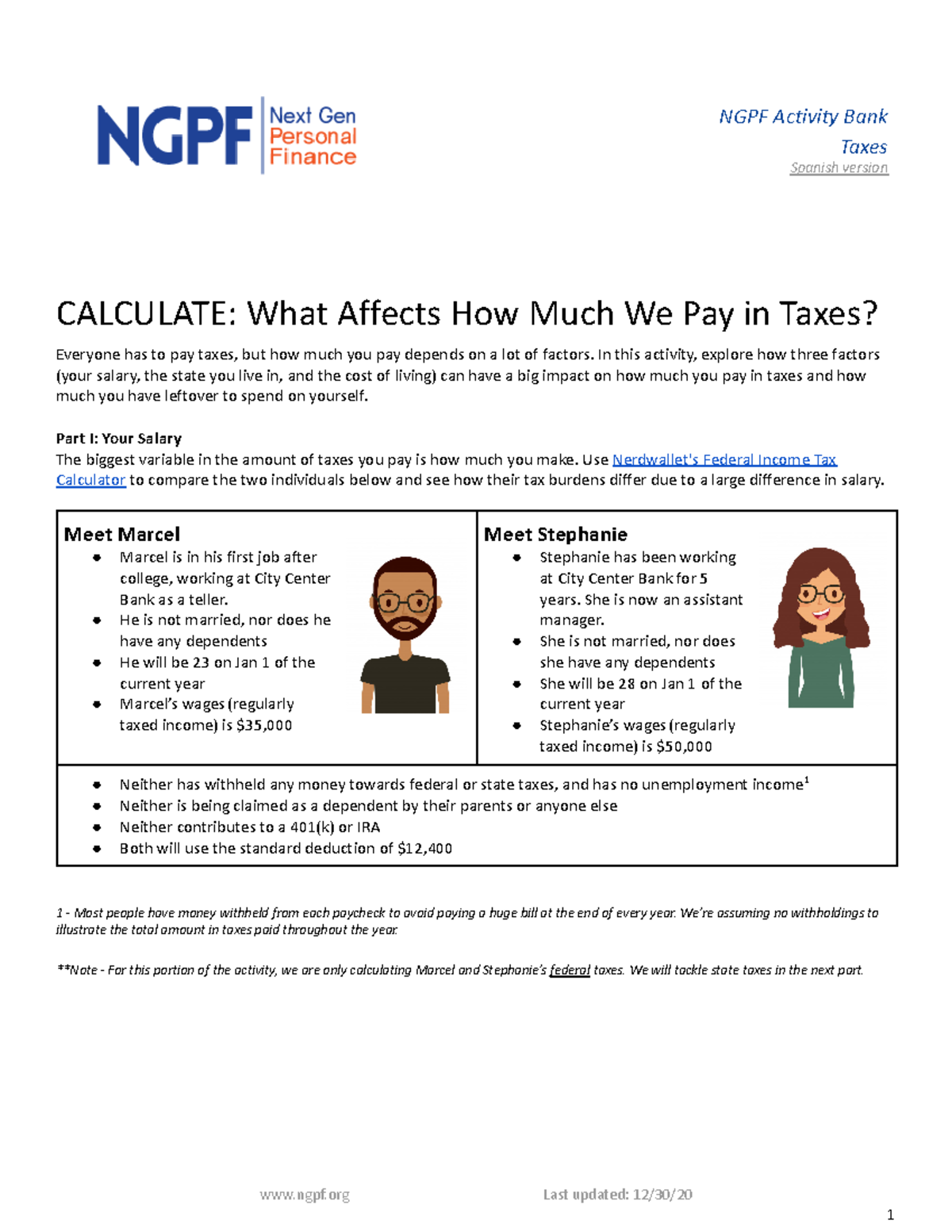

Copy Of Copy Of Calculate What Affects How Much We Pay In Taxes Hbsmba 1935 2 Harvard Studocu

401k Contribution Impact On Take Home Pay Tpc 401 K

How To Calculate Your Roth Ira And 401k Paychecks

401 K Calculator How Much Do You Need To Retire Ubiquity

401k Calculator Paycheck Deals 53 Off Www Ingeniovirtual Com

Gross Pay And Net Pay What S The Difference Paycheckcity

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Free 401k Calculator For Excel Calculate Your 401k Savings

How To Calculate Your Roth Ira And 401k Paychecks